Hey friends,

For decades, the name "Maersk" was almost synonymous with global container shipping. They were the undisputed giants, the benchmark against which all others were measured. But quietly, steadily, and with a relentless drive that few saw coming, another company began its ascent. And then, almost without a global fanfare, they surpassed them. We're talking about Mediterranean Shipping Company (MSC), the Swiss-Italian powerhouse that has now officially claimed the title of the world's largest container shipping line by vessel capacity.

For those of us navigating the intricate waters of maritime, procurement, and logistics, MSC's rise isn't just a change in rankings; it's a masterclass in strategic execution, risk-taking, and a distinct business philosophy that sets them apart from their publicly traded peers. In an industry known for its cycles and fierce competition, MSC's journey to the top offers invaluable lessons.

So, let's pull back the curtain on this often-private giant and uncover the unique strategies that propelled MSC to the summit of global shipping. We'll explore their distinctive approach, unravel the reasons behind their rapid growth, and, most importantly, distill some valuable takeaways we can all apply in our own organizations.

The Quiet Giant: A Family-Owned Powerhouse

Unlike many of its publicly listed competitors (like Maersk or CMA CGM, which is still family-owned but more public in its communication), MSC has always maintained a relatively low profile, preferring to let its actions speak louder than its words. Founded in 1970 by Gianluigi Aponte, it has remained a family-owned and operated business, a characteristic that fundamentally shapes its strategy.

This private ownership structure is key to understanding MSC's distinct approach. It allows for:

Long-Term Vision: Decisions are made with decades, not quarterly reports, in mind. This enables bold, capital-intensive bets.

Agility and Speed: Less bureaucracy means quicker decisions, crucial in a volatile market.

Risk Appetite: A willingness to take calculated risks that publicly traded companies might shy away from due to shareholder pressure.

MSC’s Ascent: The Playbook for Domination

MSC's strategy for growth can be broken down into several interconnected pillars, often executed with a boldness that has surprised competitors.

1. Aggressive Fleet Expansion: Betting Big on the Ocean

This is, arguably, the most visible and impactful aspect of MSC's strategy. While many competitors paused or slowed vessel orders during market downturns, MSC consistently invested in new and larger ships, effectively "buying low" when others hesitated.

Opportunistic Ordering: MSC capitalized on periods of low new-build prices in shipyards, placing massive orders for ultra-large container vessels (ULCVs) when others were more cautious. They were not afraid to over-order to gain market share.

Second-Hand Market Savvy: Beyond new builds, MSC was also highly active in the second-hand vessel market, acquiring ships quickly and at competitive prices, rapidly increasing their capacity.

Focus on Megaships: Their fleet includes some of the world's largest container ships, maximizing economies of scale on main East-West trade lanes. These huge vessels (carrying 24,000+ TEUs) allow for lower slot costs per container, making them highly competitive.

Lesson Learned: In capital-intensive industries, strategic counter-cyclical investment can be a powerful driver of market share. Being brave when others are fearful, and having the financial backing to execute, can lead to significant long-term gains.

2. Independent Operations & Network Control

For years, MSC was part of the 2M Alliance with Maersk, sharing vessel space and optimizing routes. However, even within alliances, MSC maintained a strong sense of operational independence and eventually decided to part ways with Maersk, signaling their confidence in their own network.

Direct Port Relationships: MSC often develops direct relationships with port authorities and terminal operators, giving them greater control over port calls and potentially better service levels.

Balanced Network: They focus on building a robust, comprehensive global network that can serve diverse trade lanes, ensuring reliability and flexibility for their customers.

Focus on Core Shipping: Unlike some peers who heavily diversified into integrated logistics solutions early on, MSC doubled down on its core strength of container shipping, ensuring excellence in its primary offering.

Lesson Learned: While collaboration (like alliances) has its benefits, maintaining strong operational control and direct relationships with key nodes in your supply chain can be a significant competitive advantage, especially when scaling up.

3. Strategic Vertical Integration: Ports, Logistics, and Beyond

While prioritizing core shipping, MSC has also quietly and strategically built out its vertical integration, particularly in port terminals and inland logistics.

Terminal Investments: Through its Terminal Investment Limited (TiL) subsidiary, MSC has invested heavily in acquiring stakes in container terminals around the world. This provides guaranteed berth space, better operational control, and more efficient turnaround times for their vessels – a crucial factor as ships get larger.

Intermodal Expansion: They have significantly invested in rail, barge, and trucking operations, especially in Europe and North America, to offer end-to-end logistics solutions. This allows them to offer seamless connections from port to final destination.

MSC Air Cargo: A more recent but significant move, MSC launched its own air cargo division, acquiring aircraft to offer air freight services. This diversification allows them to provide truly multimodal solutions, cater to high-value, time-sensitive cargo, and compete with integrated logistics giants.

Lesson Learned: Strategic vertical integration, focused on critical bottlenecks (like ports or first/last mile), can unlock significant efficiencies, enhance service reliability, and create new revenue streams, strengthening your overall value proposition.

4. Customer-Centricity (Behind the Scenes):

Despite their focus on assets and scale, MSC is known for its customer focus, which is paramount in a relationship-driven industry.

Personalized Service: Often, being family-owned translates into a more personalized approach to customer relationships, fostering loyalty.

Reliability: By building a robust network and controlling key assets (like terminals), they aim to provide reliable schedules and service, which is a top priority for shippers.

Flexibility: Their large fleet and extensive network allow them to offer a wide range of services and adapt to specific customer needs.

Lesson Learned: Even in asset-heavy industries, customer service and reliability remain paramount. A strong operational backbone must always serve the end goal of meeting customer needs effectively.

The MSC Effect: A New Era in Shipping

MSC's ascent to the top isn't just a statistical milestone; it marks a fascinating shift in the shipping landscape. Their strategy highlights:

The Power of Private Ownership: The ability to take a long-term view and make bold, capital-intensive decisions without quarterly pressure.

Aggressive Growth as a Defensive Strategy: In a volatile market, gaining scale can provide resilience and cost advantages that smaller players struggle to achieve.

Strategic Diversification: Expanding into adjacent services like air cargo and terminal operations strengthens their ecosystem and offers more comprehensive solutions.

A Focus on Assets: While many focused on digitalization and integrated logistics, MSC relentlessly invested in the physical assets – the ships themselves – that underpin the entire industry.

For those of us navigating the complexities of global supply chains, MSC's journey provides a powerful case study in strategic growth in a capital-intensive, volatile industry. It's a reminder that there's more than one path to the top, and sometimes, the quiet, consistent approach of betting big on core assets can be the most effective.

What do you find most compelling about MSC's growth strategy, or what lessons do you think are most applicable to your own work? I'm eager to hear your insights!

Cheers,

Fernando

⚓ Maritime Term of the Week

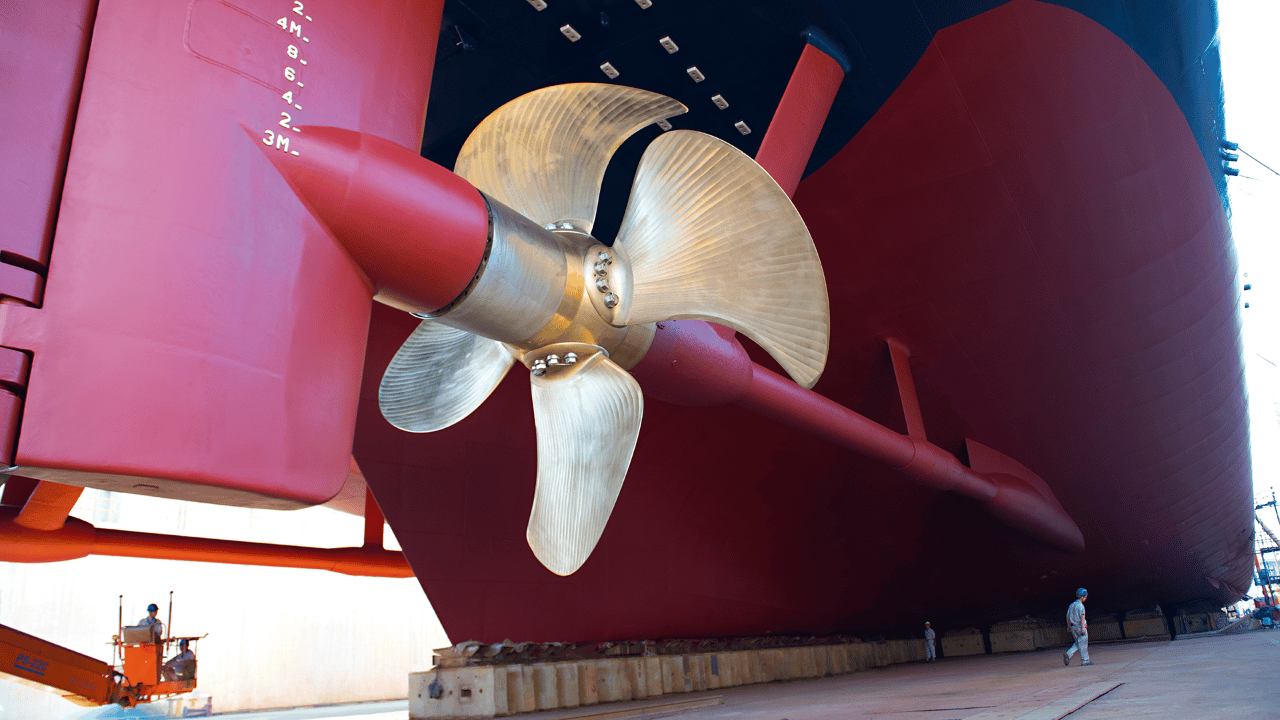

Propeller

This week, I want to talk about the unsung hero that quite literally pushes global trade forward, often hidden beneath the waves: the Propeller.

So, what exactly is a propeller in the maritime context?

Simply put, a propeller is a device with rotating blades that is used to propel a vessel through water. Think of it like a fan, but designed to work in liquid. It's connected to the ship's engine via a shaft, and when it spins, its specially shaped blades push water backwards, creating thrust that drives the ship forward. This is a brilliant application of Newton's Third Law of Motion – for every action, there is an equal and opposite reaction!

You'll typically see a propeller at the stern (rear) of a ship, consisting of a central hub with several blades, often three, four, or five, spiraling out from it. Its efficiency in converting the engine's power into forward motion is absolutely critical to a vessel's speed, fuel consumption, and overall performance.

Where does this come from?

While the idea of using a rotating screw to move water (like Archimedes' screw for irrigation) dates back to antiquity, its practical application for ship propulsion is a much more recent invention. For centuries, ships relied on oars or, predominantly, sails.

The true breakthrough for the modern screw propeller came in the early to mid-19th century. Several inventors, often working independently, contributed to its development. Key figures include Josef Ressel in Bohemia (early 1800s), and notably Francis Pettit Smith in the UK and John Ericsson in the US, both of whom had successful propeller-driven vessels operating in the 1830s.

The propeller quickly demonstrated superior efficiency compared to the cumbersome and vulnerable paddle wheels that were popular on early steamships. Its ability to operate fully submerged, offering better protection and less drag, quickly made it the dominant form of marine propulsion, laying the groundwork for the modern shipping industry.

What has evolved?

The evolution of the propeller has been a continuous journey of refinement, driven by the demand for greater efficiency, maneuverability, and power:

Fixed vs. Controllable Pitch: Early propellers were almost all "fixed pitch" – meaning the angle of their blades was set. A major evolution was the Controllable Pitch Propeller (CPP), which allows the angle of the blades to be adjusted. This means the ship can change thrust (and even go in reverse) without needing to change the engine's direction, offering much better maneuverability and efficiency at varying speeds or loads.

Specialized Designs: Beyond the basic fixed and controllable pitch, designs have become highly specialized:

Ducted Propellers (Kort Nozzles): A nozzle around the propeller, often used on tugboats, enhances thrust at lower speeds.

High-Skew Propellers: Blades are curved back ("skewed") to reduce vibration and noise, improving comfort and reducing wear on the ship's structure.

Aft-Body Optimization: Naval architects now meticulously design the hull shape around the propeller to ensure the smoothest possible water flow, minimizing turbulence and maximizing efficiency.

Materials and Manufacturing: Propellers are now made from advanced alloys (like manganese bronze) for strength, corrosion resistance, and ductility. Manufacturing processes use highly precise CNC (Computer Numerical Control) machining to create complex, hydrodynamically optimized blade shapes that were impossible to produce in the past.

Cavitation Control: A major challenge is "cavitation," where water vapor bubbles form and collapse, causing noise, vibration, and damage to the propeller blades. Modern designs and materials are developed to minimize this phenomenon.

Integrated Propulsion Systems: Perhaps the most significant evolution is the integration of propellers into steerable units like Azimuth Thrusters or Podded Propellers (e.g., Azipods). These units contain the electric motor inside the pod driving the propeller, and can rotate 360 degrees, eliminating the need for a separate rudder and offering unparalleled maneuverability, even for the largest vessels.

Environmental Focus: Current propeller design also considers minimizing underwater radiated noise, which is crucial for marine life, and maximizing efficiency to directly contribute to lower fuel consumption and reduced greenhouse gas emissions.

From a simple screw to a highly engineered, silent powerhouse, the ship propeller remains a fundamental marvel of marine engineering, continuously evolving to meet the demands of modern global shipping.

If you’d like to contribute a term for a future edition, feel free to reply to this email or send me a DM — I’d love to hear your ideas.

🧠 Wisdom Gems I Heard

What you’re not changing, you’re choosing